Discover how tokenization is redefining the approach to M&A processes, opening up new opportunities in the financial landscape.

On May 15, the Decree Law 25/2023, known as the Fintech Decree, was converted into law, introducing a series of innovations in the field of digital financial instruments. Among these, the tokenization emerges as a concept destined to redefine merger and acquisition (M&A) processes by opening the door to new opportunities and challenges for entrepreneurs and businesses. Let’s see how.

Tokenization: Transforming Physical Assets into Digital Assets

Tokenization allows the conversion of physical assets, such as real estate, into “tokens”, which are digital assets registered on a blockchain. These tokens represent specific shares of a certain asset and can be traded, sold and bought, just like shares in a company.

To make the concept clearer, let’s imagine a pie divided into slices, where each slice represents a share of the good. Tokenization replaces the physical distribution of slices with the distribution of tokens that certify possession. This allows anyone who holds the tokens to sell, buy or trade their share.

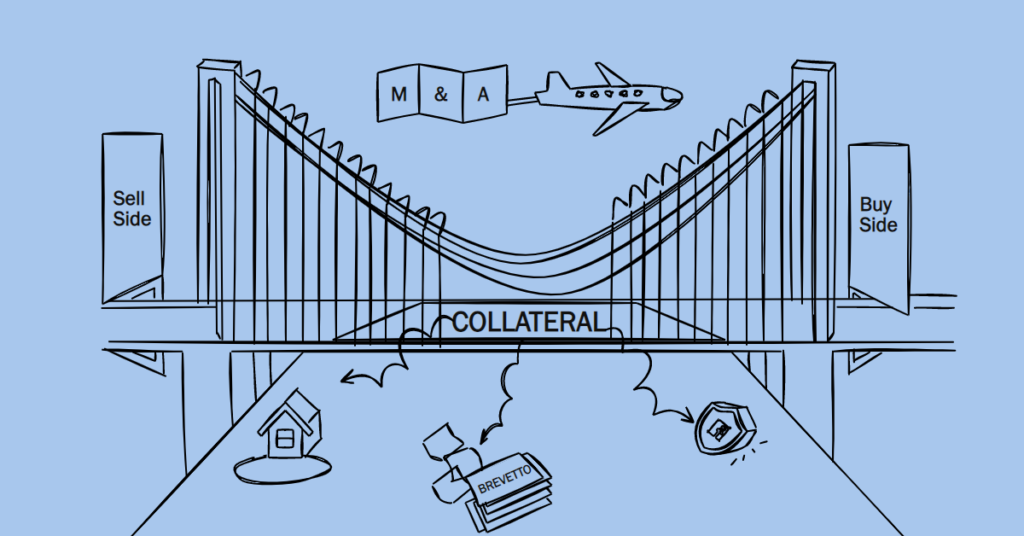

Tokenization and Collateral

In the context of M&A processes, tokenization plays a fundamental role in the management of collateral. Collateral represents guarantees attached to real estate or intangible assets and offers insurance for both the buyer and the seller in the event that M&A agreements are not respected. However, collateral management can present challenges in terms of valuing and determining their true value, especially when dealing with intangible or illiquid assets. Tokenization simplifies these issues, providing a level of transparency and ease of exchange that reduces the risk of illiquidity and simplifies the valuation of collateral, regardless of its nature.

The Impact on the Financial Landscape and on the M&A Processes

Tokenization represents a revolution in the financial sector and in M&A processes, redefining the way we think about transactions, ownership and guarantees. This innovation, based on blockchain technology, offers greater efficiency, transparency and liquidity, simplifying asset management and opening up new opportunities for investors.

Through tokenization, traditional assets are transformed into digital tokens and registered on a blockchain, a technology that ensures the secure and immutable recording of transactions. This process increases transparency and data integrity, making transactions more reliable and allowing for a smoother flow of M&A deals. Furthermore, the use of the blockchain facilitates the management and evaluation of intangible or illiquid assets, also simplifying the evaluation of collateral.

One of the most significant aspects of tokenization is the increase in liquidity of tokenized assets. This overcomes the traditional barriers and delays associated with conventional transactions, offering greater flexibility and accessibility to investors. Tokenization opens up new perspectives for buyers and sellers, enabling them to quickly, securely and transparently exploit M&A opportunities.

In general, tokenization, supported by blockchain technology, is influencing the entire business landscape by offering greater participation and accessibility to investors and also improving the efficiency and transparency of M&A transactions.