Protecting your business from the threat of financial cascade in an interconnected world.

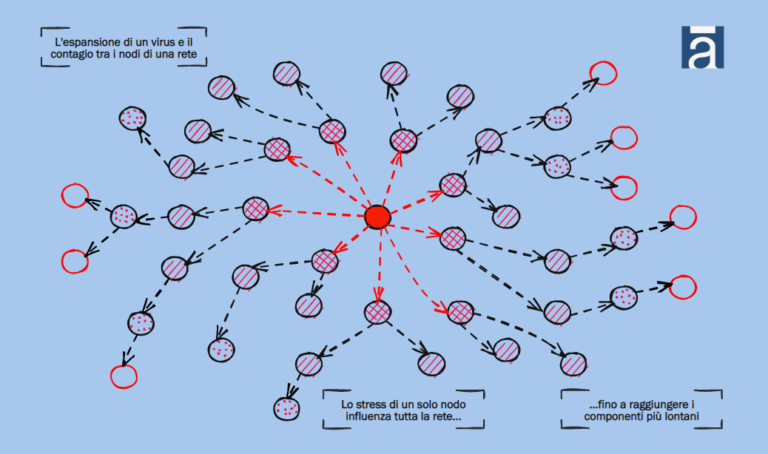

Di contatti, contagi e trasmissioni, ne abbiamo avuto esperienza diretta durante la pandemia. E la crisi di un settore presenta caratteristiche di sviluppo simili. Come illustrato nel recente paper 'Financial Contagion in Network Economies and Asset Prices’ di Andrea Buraschi e Claudio Tebaldi, un virus può diffondersi in tutta la comunità, e allo stesso modo una sola azienda può innescare una reazione a catena che si propaga lungo l’intera rete economica, colpendo anche aziende fino ad allora in salute.

Un'azienda indebitata che subisce uno shock finanziario influenza i bilanci dei creditori e riduce la loro capacità di erogare ulteriori crediti , con conseguenze per tutte le imprese interconnesse.

In questo contesto, è fondamentale che chi guida le aziende sia consapevole delle diverse dinamiche della crisi e che le imprese siano in grado di resistere e adattarsi alle sfide impreviste.

Subcritical and supercritical: the dynamics of a crisis.

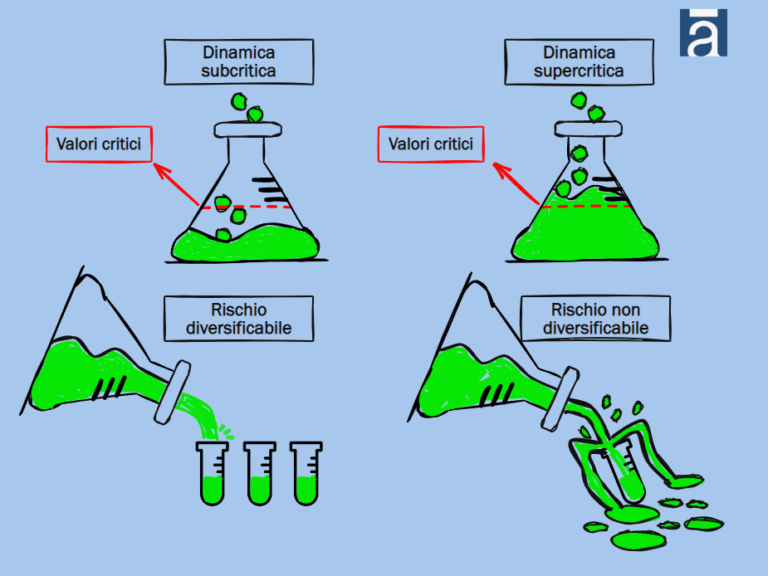

A crisis develops following two different dynamics: subcritical and supercritical, depending on whether the threshold values that determine the critical state have already been surpassed or not.

In the subcritical dynamics, an investor can balance the risk of their portfolio by investing in multiple companies that are not closely correlated with each other, in order to limit the impact of negative events on a single company. In the supercritical dynamics, instead, specific shocks to companies can lead to a “cascading effect.“ involving the entire financial system. In this case, the risk cannot be diversified, as the difficulties of a single company can propagate throughout the entire network.

Vulnerable and systemic companies.

The dynamics of crises and the associated risks make a sector characterized by vulnerable and systemic companies.

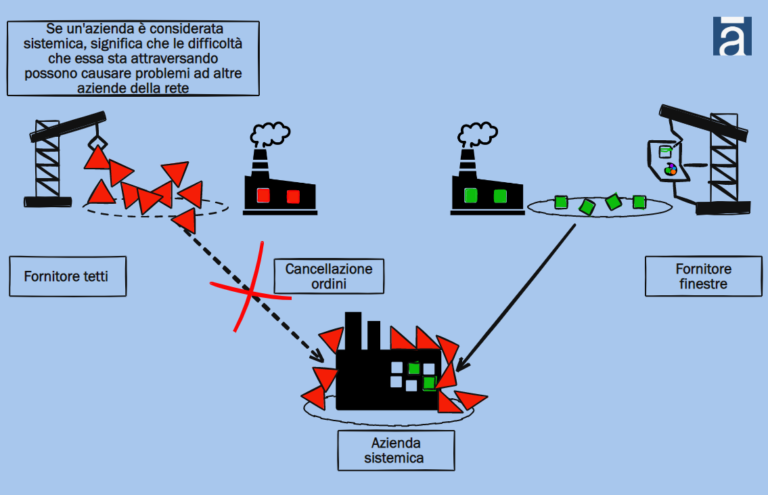

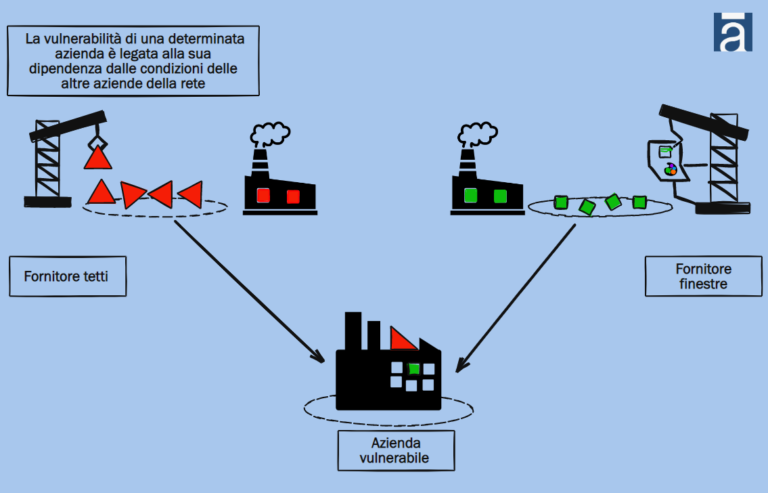

The vulnerability of a company depends on the conditions of other companies in the network, while a systemic company has a strong impact on the conditions of other interconnected companies. In a supply chain, for example, stress experienced by a producer (systemic company) will reduce the production efficiency of the entire chain (vulnerable companies).

Overall, these assumptions also have financial relevance as it is possible to assess the financial risk associated with the interconnection between companies. These shocks, which can be triggered by even relatively small events, can have persistent effects on the company and the network, altering their long-term behavior.

Essentially, the dynamics of contagion among companies can produce a chain effect, where the crisis of a single company can lead to the crisis of the entire economic network.

These dynamics resemble concepts from epidemiology and can be compared to a persistent and constant epidemic in a population. In other words, the more companies involved in the network of interconnections, the greater the risk of a cascade of financial shocks that can have long-term effects on the network itself.

Mitigating the threat of a cascade.

The threat of a cascade of financial shocks is real for any network of interconnected companies and depends on the overlap between vulnerable and systemic companies.

A financial crisis of a single company can propagate along a supply chain, disrupting the production of other businesses and amplifying the cascade effect. Detecting a crisis in a timely manner is therefore vital both for the company itself and for the entire ecosystem of interconnected companies. This is because a small crack in one parameter of a company can quickly spread and involve an entire sector, becoming a difficult-to-mend chasm.